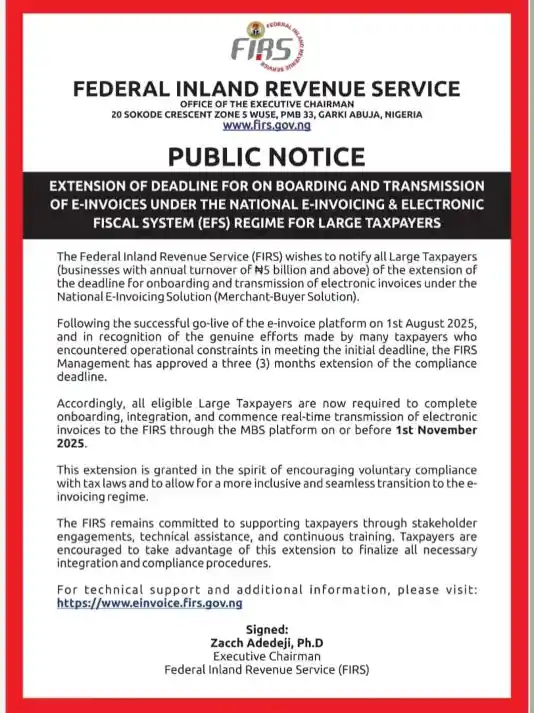

August 11, 2025 – The Federal Inland Revenue Service (FIRS) has announced a three-month extension for the onboarding and transmission of electronic invoices under the National E-Invoicing and Electronic Fiscal System (EFS) regime. The extension applies to large taxpayers, defined as businesses with an annual turnover of five billion naira and above.

According to the FIRS, the e-invoice platform, also known as the Merchant-Buyer Solution, went live on 1 August 2025. However, many eligible businesses experienced operational challenges in meeting the original compliance deadline. In response, the FIRS management has approved a new deadline of 1 November 2025.

“This extension is granted in the spirit of encouraging voluntary compliance with tax laws and to allow for a more inclusive and seamless transition to the e-invoicing regime,” the statement from the Office of the Executive Chairman read.

Under the new arrangement, all large taxpayers must complete onboarding, integration, and begin real-time transmission of e-invoices to the FIRS through the MBS platform before the revised deadline.

The extension is aimed at improving efficiency in tax administration and enhancing transparency in business transactions across Nigeria.

The Executive Chairman, Zacch Adedeji, Ph.D, reaffirmed the agency’s commitment to providing technical assistance, stakeholder engagement, and continuous training to support taxpayers. He urged eligible companies to use the additional time to finalise their system integration and meet all compliance requirements.

The FIRS further encouraged taxpayers to access technical support and guidance through its official e-invoicing portal at www.einvoice.firs.gov.ng.

The public notice, issued from the FIRS headquarters at 20 Sokode Crescent, Zone 5 Wuse, PMB 33, Garki Abuja, also highlighted the government’s intention to modernise tax collection systems and strengthen the Nigerian economy through the adoption of technology-driven solutions.