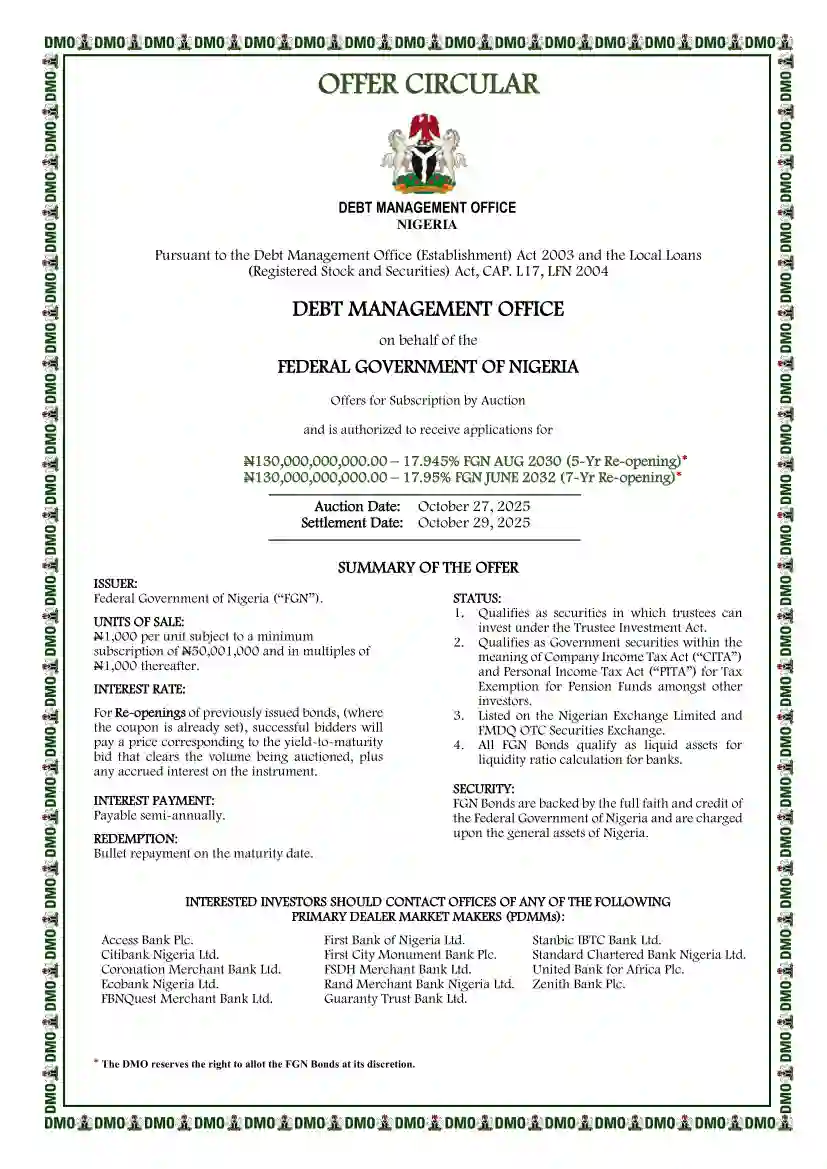

The Federal Government of Nigeria, through the Debt Management Office (DMO), has announced the auction of two Federal Government of Nigeria Bonds for October 2025. The DMO confirmed that the auction will take place on October 27, 2025, while settlement is scheduled for October 29, 2025.

According to the official Offer Circular released by the DMO, the total amount on offer is ₦260,000,000,000.00, split equally between two instruments. These are ₦130,000,000,000.00 for the 17.945% FGN AUG 2030 (5-Year Re-opening) and ₦130,000,000,000.00 for the 17.95% FGN JUNE 2032 (7-Year Re-opening).

The statement from the Debt Management Office reads, “On behalf of the Federal Government of Nigeria, we are offering for subscription via auction the following FGN Bond offerings detailed in the Offer Circular below.” The bonds are issued under the Debt Management Office (Establishment) Act 2003 and the Local Loans (Registered Stock and Securities) Act, CAP. L17, LFN 2004.

Each unit of the bond is priced at ₦1,000, subject to a minimum subscription of ₦50,001,000 and in multiples of ₦1,000 thereafter. For the re-opening of previously issued bonds, successful bidders will pay a price corresponding to the yield-to-maturity bid that clears the auctioned volume, along with any accrued interest. Interest on the FGN bonds will be paid semi-annually, while redemption will be made in full at maturity.

The bonds qualify as securities in which trustees can invest under the Trustee Investment Act and are recognized as Government securities under both the Company Income Tax Act and the Personal Income Tax Act. They are also exempt from tax for Pension Funds and listed on both the Nigerian Exchange Limited and FMDQ OTC Securities Exchange.

The DMO further noted that all FGN Bonds are regarded as liquid assets for banks’ liquidity ratio calculations and are backed by the full faith and credit of the Federal Government of Nigeria.

Interested investors are advised to contact any of the Primary Dealer Market Makers, including Access Bank, Zenith Bank, GTBank, UBA, First Bank, Stanbic IBTC, and others. The DMO stated that it reserves the right to allot the FGN Bonds at its discretion.