Public affairs analyst, Jide Ojo, has expressed concerns over the effectiveness and long-term impact of the N25,000 Federal Government’s expanded direct cash transfer programme, despite recent assurances of improved transparency and reach.

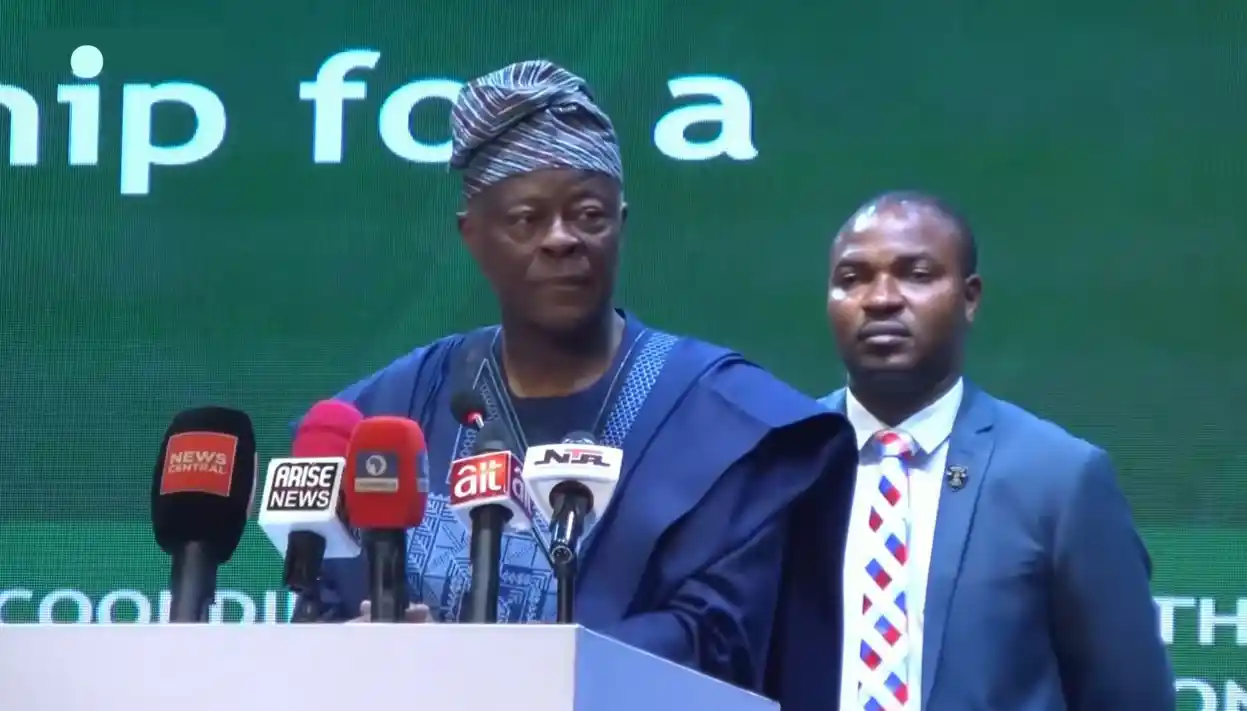

Previously, Nigeriastartupact.ng reported that the Minister of Finance and Coordinating Minister of the Economy, Wale Edun, had on Tuesday announced that the Federal Government plans to expand its direct cash transfer initiative to include more poor and vulnerable Nigerians. Edun disclosed this at the Oxford Global Think Tank Leadership Conference and book launch held in Abuja on Tuesday, stating that over 15 million households are currently benefiting from the scheme.

According to Edun, the initiative is part of the government’s broader effort to cushion the effects of ongoing economic reforms under President Bola Tinubu. He explained that leadership change in 2023 brought renewed focus and that the administration has recorded significant progress in stabilizing the economy.

“Leadership changed in 2023, and under President Bola Tinubu, change has been for the better. If you look at the record, if you look at the statistics, if you look at the progress that has been made since 2023, the improved growth rate, the stable exchange rate, the lowering inflation, those are just one side of the story,” Edun said.

He added that the government’s focus remains on improving the human side of the economy. “The most important aspect is the human side: the effect on people’s daily experiences, the cost of food, the cost of transport, how they are living their lives. This report stands both as a call to reflection and an invitation to urgent action,” he said.

The minister further emphasized that Nigeria’s economic growth must now rely more on knowledge and innovation. “Today’s global competition is no longer fought in factories alone. It is anchored in what I call the new factors of economic production. We can do much better with the abundance of human and material resources that our country is blessed with. We live in a new era where wealth is tied to knowledge, and there is a lot of advantage for us in this regard,” Edun added.

Reacting to the announcement, public affairs analyst Jide Ojo, who joined a live TVC News discussion via Zoom, acknowledged the government’s improved efforts in transparency but questioned the real impact of the cash transfer on Nigerian households.

“I listened to the minister attentively, and this time around, they collected the National Identification Number of all the beneficiaries, and the money is not given to them via cash. It is transferred into their wallets or into their bank accounts. That gives a higher level of transparency than what was done under the Muhammadu Buhari administration, where ₦5,000 or ₦10,000 that was given at that time was handed out manually, without biometrics, without data beyond the names and addresses of the beneficiaries,” Ojo explained.

He noted that while the process now ensures greater accountability, the actual financial assistance being provided may not achieve meaningful poverty reduction. “So, to that extent, I think what is being done under President Bola Tinubu has a higher level of transparency and integrity. However, where I have issues is that while it may be true that we have 15 million beneficiaries, this conditional cash transfer, which is ₦25,000 for three months, is too little to impact a family positively,” he said.

Ojo argued that inflation and currency depreciation have drastically reduced the purchasing power of Nigerians. “If you look at 2023 to date and the devaluation of the naira, what ₦25,000 could buy under the Buhari administration was higher in value than what it can buy now. It’s like what you could buy with ₦25,000 under that administration is what you now need ₦100,000 to buy,” he explained.

He added that even though the government is spending a large amount, the value does not match the current cost of living. “If you are talking about 15 million families, not just 15 million individuals, for three months, that’s a total of ₦75 billion. It’s not consequential in terms of the value of the currency,” Ojo stated.

When asked about the accuracy of the social register guiding the programme, Ojo noted that the database was built with international support and is relatively credible. “We do. I understand that the social register currently in use was built with support from the World Bank. If you recall, when the Tinubu administration came in 2023, some governors had issues with the data in the social register and decided that they were going to have their own registers and all of that. But I think we’ve gone past that,” he said.

Ojo, however, maintained that while data might not be the main challenge, the core problem lies in the economic value of the assistance being offered. “The bottom line is that these vulnerable people do exist. But my argument is: yes, assuming, without conceding, that 15 million people are benefiting right now, and giving the government the benefit of the doubt, the value of this ₦25,000 for three months is insignificant. It will not buy much for a family of four; they cannot survive on it,” he added.

He also raised concerns about rising living costs and the limited duration of the support. “Even the minister himself mentioned issues around transportation and feeding. What about shelter? In my neck of the woods, where I’m talking to you from, accommodation has increased by 100 percent. So, what will you be able to do with ₦25,000? And then after three months, the whole program stops?” Ojo asked.

He concluded by urging the Federal Government to adopt more sustainable poverty reduction strategies that go beyond short-term relief. “Government needs to look at how to ameliorate poverty beyond the conditional cash transfer,” he said.

The expanded direct cash transfer programme is one of the government’s flagship social intervention policies aimed at reducing poverty and supporting low-income families amid economic reforms. However, while the policy is well-intentioned and transparent, its limited duration and low value make it insufficient to address the current cost-of-living crisis facing millions of Nigerians.